Many people think being poor is only about not earning enough money. But in truth, your mind plays a huge role in your financial life. Certain ways of thinking — called “psychological traps” — can quietly keep you stuck in financial struggles, even when you work hard.

In this post, we’ll explore five common mental traps that make people poor. More importantly, you’ll learn smart, science-backed ways to avoid falling into them. By recognizing and beating these traps, you can take real steps toward building wealth and financial freedom.

1. Instant Gratification: Choosing Now Over Later

Instant gratification is when you want something right away instead of waiting for a better reward in the future.

Think about times when you bought something expensive you didn’t really need — just because it felt good in the moment.

Why It Makes You Poor

- You spend money quickly without thinking.

- You save less for emergencies or investments.

- You might end up in debt, paying for past pleasures.

The Science Behind It

In the Stanford Marshmallow Experiment (1970s), children were given a choice: eat one marshmallow now, or wait 15 minutes and get two. Years later, researchers found that the kids who waited ended up with better jobs, health, and financial security.

The lesson: Being able to wait for a bigger reward is linked to long-term success.

How to Outsmart Instant Gratification

- Automate Your Savings: Set up automatic transfers to a savings or investment account, so you never even see the money you’re saving.

- Use the 48-Hour Rule: Wait two days before making big purchases. Most times, the “want” will fade.

- Picture Your Future Self: Studies show that visualizing yourself in the future makes you more likely to make smarter financial choices today.

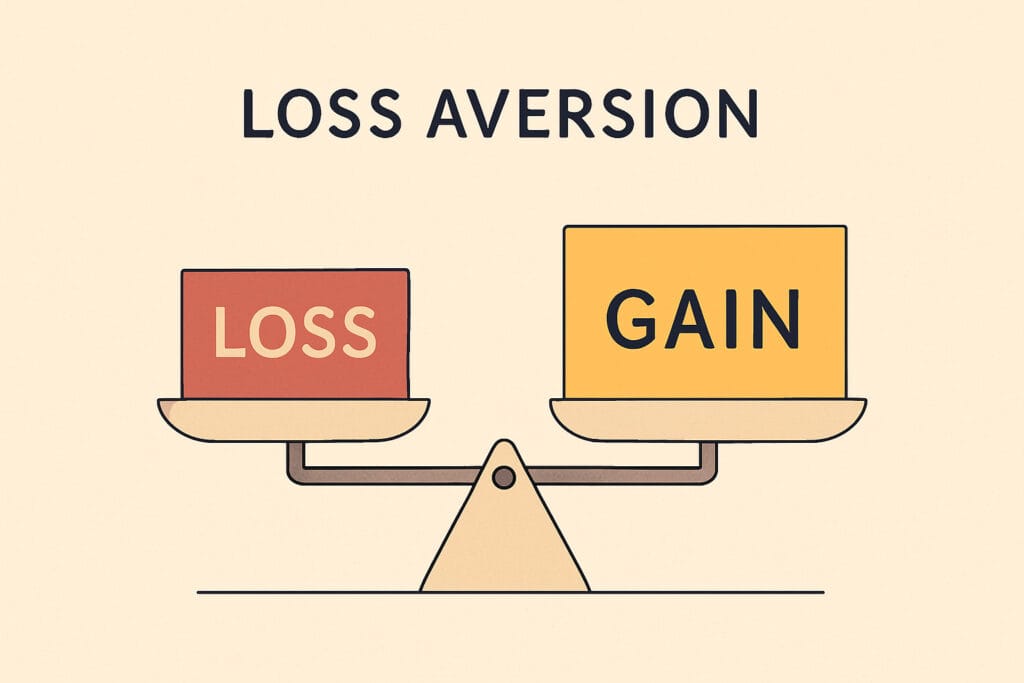

2. Loss Aversion: Fear of Losing Overpowers the Joy of Winning

Loss aversion means we feel the pain of losing money twice as strongly as the happiness of gaining it.

For example, losing $100 feels terrible — much worse than the joy of winning $100.

Why It Makes You Poor

- You might avoid good investments because you’re scared of small risks.

- You might panic and sell your investments during a market drop, locking in losses.

- You miss out on long-term growth by playing it too safe.

The Science Behind It

Daniel Kahneman and Amos Tversky studied this and found that most people are risk-averse, even when taking a small risk could mean a bigger reward.

In fact, investors who let fear control them tend to earn 3–5% less per year, according to a 2021 Morningstar study.

How to Outsmart Loss Aversion

- Think Long-Term: Remember, markets go up and down in the short term — but over 10–20 years, they usually rise.

- Focus on Missed Opportunities: Think about what you’re losing by not investing, not just what you might lose by investing.

- Use Dollar-Cost Averaging: This means investing a little bit regularly, which reduces the fear of bad timing.

3. Status Quo Bias: Sticking to What’s Comfortable

Status quo bias is the tendency to stick with what you know — even if it’s not working well.

For example, keeping your money in a savings account earning almost no interest because “it’s safer” — while inflation eats away at it.

Why It Makes You Poor

- You miss better opportunities to grow your money.

- You stay in bad financial habits just because change feels hard.

- You may stay in a low-paying job instead of seeking better opportunities.

The Science Behind It

In a famous study by Samuelson and Zeckhauser (1988), people were more likely to stick with their current choices, even when offered clearly better options.

The brain prefers familiarity over uncertainty — even when the new path is smarter.

How to Outsmart Status Quo Bias

- Schedule a Financial Review Every Year: Look at your savings, investments, insurance, and expenses. Ask: “Is this the best option available right now?”

- Treat Changes as Experiments: Try new ideas on a small scale. If they work, expand them.

- Use Tools and Apps: Apps like Mint or YNAB can help you easily track and adjust your finances.

4. Overconfidence (The Dunning-Kruger Effect): Thinking You Know More Than You Do

The Dunning-Kruger effect describes how people with less knowledge often believe they are experts.

In personal finance, this can be dangerous. You might jump into risky investments or ignore good advice because you think you “already know enough.”

Why It Makes You Poor

- You may take big risks without understanding them (like buying stocks based on hype).

- You might refuse professional advice that could save or earn you money.

- You underestimate how complicated wealth-building can be.

The Science Behind It

Research in the Journal of Financial Planning found that people who were overconfident about their money skills actually performed worse financially than those who admitted they needed help.

Knowledge is powerful — but knowing what you don’t know is even more powerful.

How to Outsmart Overconfidence

- Keep Learning: Always assume there’s more to learn about money — through books, podcasts, or trusted websites.

- Ask Experts: Financial advisors, accountants, or planners can help you avoid expensive mistakes.

- Use Checklists: Write down steps before making big financial moves, to slow down emotional decisions.

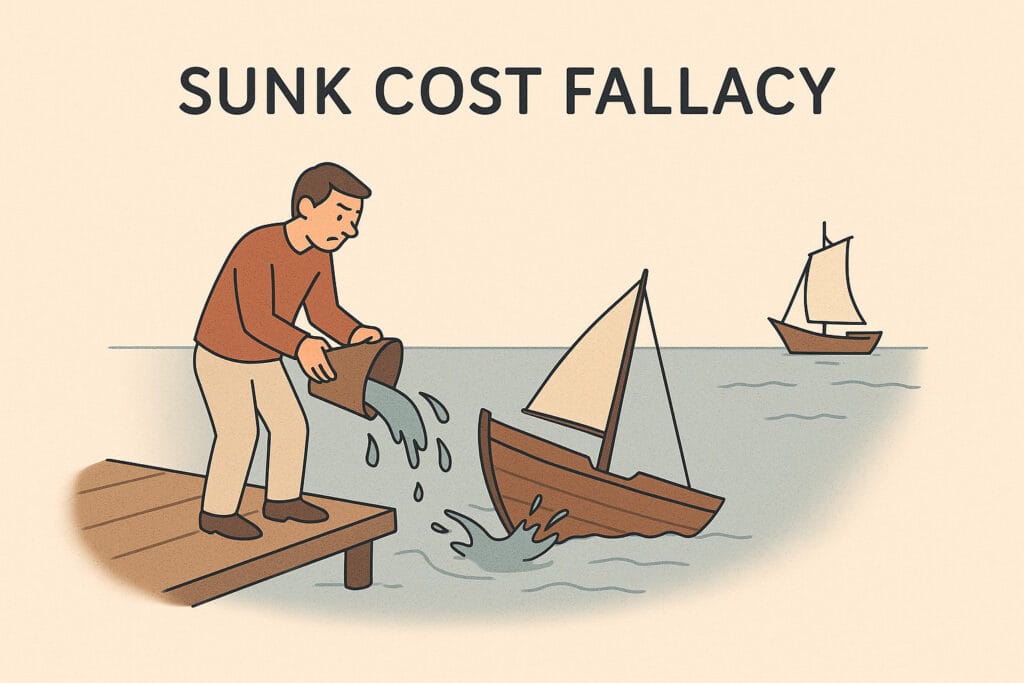

5. Sunk Cost Fallacy: Throwing Good Money After Bad

The sunk cost fallacy happens when you continue investing in something just because you’ve already spent a lot on it — even if it’s no longer a good idea.

Example: Staying in a failing business because you’ve “already spent so much time and money.”

Why It Makes You Poor

- You keep losing money instead of cutting your losses.

- You stay stuck in bad investments or poor financial choices.

- You waste time and energy that could be used more wisely.

The Science Behind It

A 2020 study in the Journal of Economic Behavior & Organization showed that recognizing sunk cost fallacy helps people make 20% better financial decisions.

Smart people know when to walk away.

How to Outsmart the Sunk Cost Fallacy

- Focus on the Future, Not the Past: Ask yourself, “Would I start this today knowing what I know now?”

- Set Limits in Advance: Before investing, decide how much you’re willing to lose or how long you’ll stick with something.

- Stay Objective: Take emotions out of decisions. If something isn’t working, it’s okay to move on.

Conclusion: Master Your Mind, Master Your Money

The truth is, money problems often start in the mind — not the wallet. Instant gratification, fear of loss, clinging to the familiar, overconfidence, and emotional attachment can quietly sabotage your financial dreams.

The good news? Once you understand these traps, you can beat them.

- Train yourself to delay gratification.

- Accept that taking smart risks is part of growing wealth.

- Keep learning and challenging old habits.

- Trust data and reason more than feelings.

- Know when to let go of past mistakes.

Financial freedom isn’t just about working harder — it’s about thinking smarter. Outsmart these traps, and you’ll be well on your way to building the life you deserve. for financial freedom why not start with doing SIP . here is how you calculate the returns , click here