In 2025, global markets aren’t just volatile—they’re being rewritten. Thanks to a sweeping new wave of tariffs introduced by Donald Trump, the global trade order is facing its biggest test since the 2018 US-China trade war.

What Are These New Tariffs in 2025?

In March 2025, Donald Trump—now the presumptive Republican nominee—announced a unilateral 10% tariff on all imported goods, with an additional 60% tariff on Chinese products. These sweeping trade measures are part of his “America First 2.0” policy.

Quick Fact: This move affects over $3 trillion worth of goods—more than double the value of goods hit by the 2018 tariffs.

Global Trade Faces a New Ice Age

These tariffs have created instant global ripples:

- 🌐 Export-driven economies like Germany, China, and South Korea face immediate contraction.

- 🛳️ Shipping and logistics companies are repricing their long-term contracts.

- 🏭 Manufacturers across Asia and Europe are pausing production and slashing forecasts.

World Trade Organization (WTO) predicts a 3.8% decline in global trade volumes by Q3 2025.

Corporate Profits Under Siege

A Wave of Profit Warnings

Major corporations are already issuing profit warnings, blaming tariff-related costs and supply chain shocks:

| Company | Impact | Estimated Loss |

|---|---|---|

| Apple Inc. | Increased cost of China-made parts | $3.1 Billion |

| Tesla | Higher import duties on EV components | $1.8 Billion |

| Walmart | Supply chain restructuring | $2.5 Billion |

| Samsung | Delayed shipments, raw material hikes | $1.2 Billion |

CEO of Walmart: “These new tariffs aren’t a speed bump—they’re a wall.”

now the best strategy can be wait for some time then find the stocks that are undervalued . you can do that using one of our tool ,Intrinsic value calculator

Why Are Tariffs So Damaging?

Let’s break down the real financial impact:

1. Supply Chain Disruptions

Global businesses rely on interconnected supply chains. Tariffs create friction at every step—from sourcing to shipping.

2. Profit Margin Compression

Companies either:

- Pass costs to consumers (risking demand),

- Or absorb losses (hurting profitability).

3. Investor Confidence Drop

Markets hate uncertainty. The Dow dropped 1,200 points post-announcement.

4. Restructuring Costs

Firms are scrambling to restructure operations, relocate suppliers, and shift logistics—all expensive moves.

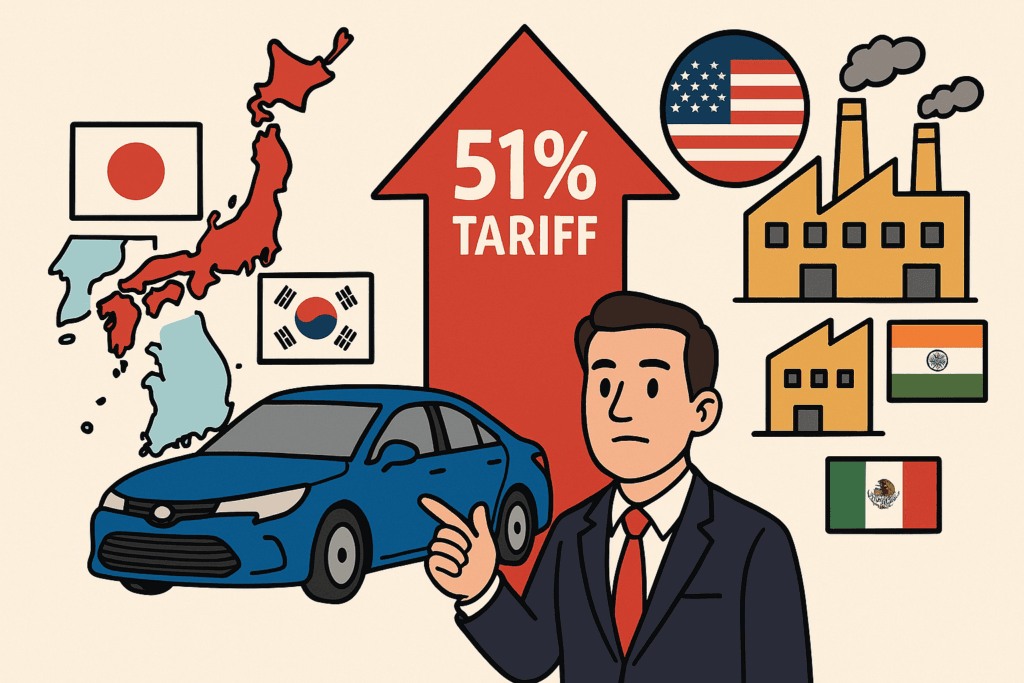

How Are Businesses Reacting?

- 📦 Amazon is nearshoring warehouses to Mexico.

- 🏭 Apple is accelerating its Vietnam and India production lines.

- 🚛 Automakers are lobbying for temporary exemptions.

These corporate pivots could shape global supply chains for the next decade.

The Bigger Economic Picture

This is not just about business—it’s a geopolitical chess game.

- 🇺🇸 US Inflation might spike again due to higher import prices.

- 🇨🇳 China’s GDP growth forecast is revised down to 4.2%.

- 🌎 Emerging markets in ASEAN and Latin America could benefit as companies flee China.

📘 According to IMF, these tariffs could shave off 1.4% of global GDP in 2025 alone.

Expert Take: Is This Sustainable?

💬 “Tariffs are a blunt instrument. They cause more pain than precision.”

— Dr. Nouriel Roubini, NYU Economist

Unless negotiations happen or exemptions are granted, we might be entering a new cold war in global trade.

💡 What This Means for YOU

Whether you’re:

- 📈 An investor looking to hedge,

- 🛒 A consumer wondering about price hikes,

- 🧑💼 A business owner managing cost inputs,

The new tariff regime changes everything. This isn’t a short-term news cycle—this is a structural shift in global economics.

Final Thoughts

In the words of Warren Buffett:

“Only when the tide goes out do you discover who’s been swimming naked.”

These tariffs are pulling back the tide. The companies that adapt fastest will thrive. The rest? They’re already bleeding.

for more read from here