In an era where convenience, speed, and personalization dictate consumer behavior, the convergence of financial services and digital commerce has birthed a transformative force—embedded finance. This new frontier in fintech is not just a buzzword; it is a strategic lever driving frictionless transactions, boosting customer engagement, and reshaping the e-commerce ecosystem.

1. What is Embedded Finance?

Embedded Finance refers to the seamless integration of financial services—such as payments, lending, insurance, and banking—directly into non-financial platforms. Rather than redirecting users to traditional banks or financial institutions, these services are built natively into e-commerce platforms, apps, or ecosystems.

📘 Academic Insight:

As per a McKinsey report (2021), embedded finance could account for over $230 billion in revenue by 2025, reflecting its exponential trajectory across sectors like retail, logistics, and technology.

2. The Rise of Embedded Finance in E-Commerce

💡 Drivers of Growth:

- Consumer Expectation for Seamless Experiences

- API-driven Fintech Infrastructure

- Open Banking & Regulatory Support

- Expansion of Digital Wallets and BNPL (Buy Now, Pay Later)

The digital transformation wave post-COVID-19 further accelerated this integration. E-commerce brands began embedding payment gateways, offering micro-loans at checkout, and providing in-app insurance—all without involving third-party redirections.

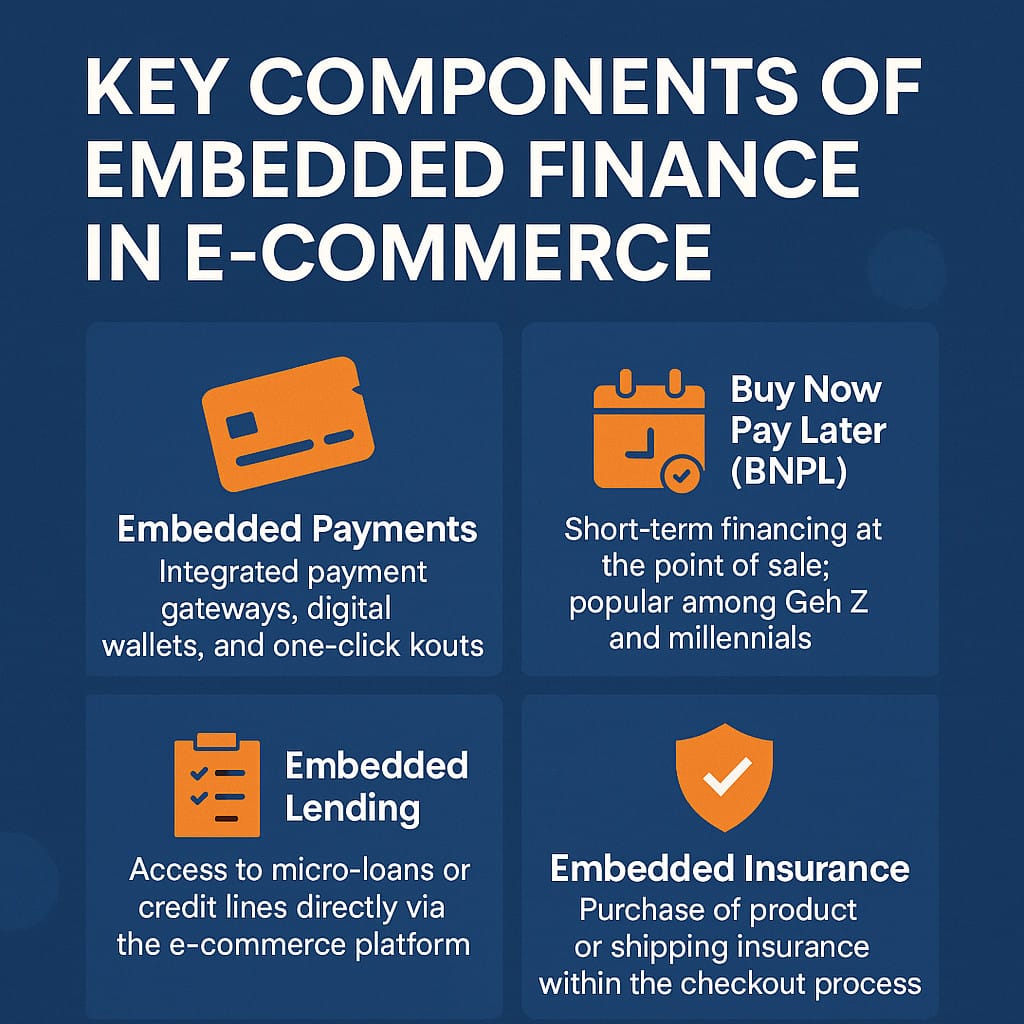

3. Key Components of Embedded Finance in E-Commerce

| Component | Description |

|---|---|

| Embedded Payments | Integrated payment gateways, digital wallets, and one-click checkouts. |

| Buy Now Pay Later (BNPL) | Short-term financing at the point of sale; popular among Gen Z and millennials. |

| Embedded Lending | Access to micro-loans or credit lines directly via the e-commerce platform. |

| Embedded Insurance | Purchase of product or shipping insurance within the checkout process. |

| Embedded Banking | White-labeled banking services such as savings accounts, debit cards, etc. |

4. Benefits for E-Commerce Businesses

✅ Enhanced User Experience:

Frictionless transactions lead to higher conversion rates and reduced cart abandonment.

✅ Increased Revenue Streams:

With value-added services like BNPL and insurance, companies monetize beyond just product sales.

✅ Better Customer Insights:

Through finance-related data, companies gain deeper behavioral analytics, enabling hyper-personalization.

✅ Brand Stickiness:

Financial tools embedded in the ecosystem reduce user churn and increase lifetime value (LTV).

5. Real-World Use Cases of Embedded Finance

Amazon Pay Later (India):

Allows eligible users to purchase on credit and repay in EMIs. Boosted Amazon’s transaction volume significantly during festive seasons.

Shopify + Affirm:

By integrating Affirm’s BNPL feature, Shopify merchants saw higher average order values and lower abandonment rates.

Apple Pay & Apple Card:

Seamlessly embedded in the Apple ecosystem, offering cashback, flexible repayment, and integrated wallet functionality.

GrabFinance (Southeast Asia):

Ride-hailing turned fintech: Grab now offers lending, insurance, and payment services natively within its super app.

6. Challenges and Regulatory Considerations

🔒 Data Privacy & Security:

Handling financial data requires robust encryption and compliance with GDPR, PCI DSS, etc.

⚖️ Regulatory Frameworks:

Navigating cross-border laws (like PSD2 in Europe or RBI norms in India) is complex and evolving.

🤝 Partner Risk:

E-commerce platforms depend on third-party fintech providers; due diligence and SLA management are critical.

7. Future Trends and Forecasts

📊 Market Growth:

According to Bain Capital (2022), embedded finance could generate $7 trillion in value globally by 2030.

🔍 AI & Personalization:

AI will drive tailored financial offerings—credit scoring, dynamic pricing, and fraud detection—within platforms.

🔗 DeFi & Tokenized Assets:

Blockchain-based financial services (like crypto wallets or tokenized rewards) are poised to integrate with e-commerce.

🌐 Super Apps:

Companies like Meta, Amazon, and Google are already morphing into financial ecosystems, merging social, commerce, and banking.

8. Conclusion

Embedded finance represents more than just a technical innovation—it marks a paradigm shift in how consumers interact with digital platforms. By internalizing financial functionalities, e-commerce companies stand to enhance customer loyalty, unlock new revenue models, and build intelligent, integrated ecosystems. As the lines between fintech and commerce blur, the future lies in invisible banking—financial services that are everywhere, but felt nowhere.

You might be surprised knowing about how many tools you get here for free , click here