In the world of personal finance and investing, people often assume that financial success comes from knowledge, IQ, or complex strategies. However, in The Psychology of Money, Morgan Housel argues that financial success is not about how much you know, but how you behave.

This book is not a traditional guide to investing or money management. Instead, it explores how emotions, psychology, and decision-making patterns impact our financial lives. Housel presents 19 lessons that reveal why people struggle with money, how to build long-term wealth, and the mindset shifts necessary for financial freedom.

If you’re an investor, entrepreneur, or someone looking to gain better control over your finances, this book provides timeless wisdom to help you navigate money more effectively.

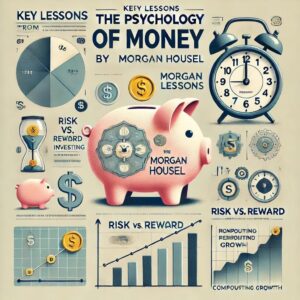

Key Takeaways from The Psychology of Money

1.Wealth is a Mindset, Not Just a Number

Many people believe that being rich means having luxury cars, designer clothes, or a big house. But Housel argues that true wealth is what you don’t see—it’s the ability to save, invest, and let money grow over time.

- Rich people show off material possessions.

- Wealthy people have financial security, savings, and freedom.

Lesson: If you want long-term financial success, focus on growing your net worth rather than spending to impress others.

2. The Role of Luck and Risk in Money

Financial success isn’t always about skill; luck and risk play a huge role in investment outcomes.

Housel gives the example of Bill Gates, who had access to a computer at a young age, an opportunity that was incredibly rare. A similarly intelligent person without that access might not have achieved the same success.

- Luck can help you, but it shouldn’t make you overconfident.

- Risk can hurt you, but it shouldn’t make you overly fearful.

Lesson: Acknowledge the role of luck in your life and make decisions that minimize risk while maximizing potential gains.

3. The Power of Compounding & Long-Term Thinking

Most people underestimate the power of compounding. Small, consistent investments can lead to massive returns over decades.

Housel highlights how Warren Buffett became one of the richest people in the world not just because he’s a great investor, but because he started investing early and stayed in the market for decades.

Consider this:

- Investing ₹10,000 per month at a 12% return can grow into ₹1.76 crore in 25 years.

- The key is staying invested and letting time do the work.

Lesson: Start investing early and avoid panic-selling in volatile markets.

4. Financial Freedom > Luxuries

People often assume money leads to happiness. But Housel argues that money doesn’t buy happiness—it buys freedom.

- The richest people in the world aren’t necessarily the happiest.

- True financial success is about having control over your time.

- The ability to work on your terms and reduce financial stress is the ultimate goal.

Lesson: Stop chasing wealth for the sake of luxury—use money to buy flexibility and control over your life.

5. Why People Make Poor Financial Decisions

Even smart people make terrible financial decisions because they let emotions drive their choices.

- Fear of missing out (FOMO) leads people to invest in hype-driven stocks.

- Overconfidence makes people take excessive risks.

- Short-term thinking causes people to sell assets too soon.

Instead of following trends, focus on building a personal financial strategy based on long-term goals.

Lesson: The biggest risk to your money isn’t the market—it’s your own emotions.

How to Apply The Psychology of Money to Your Life

Now that we’ve explored the key insights, how can you apply them to your financial life?

1. Build a Financial Safety Net

- Always have an emergency fund to cover at least 6 months of expenses.

- Avoid lifestyle inflation—just because you earn more doesn’t mean you need to spend more.

2. Invest with a Long-Term Perspective

- Stop chasing get-rich-quick schemes.

- Start investing in index funds, stocks, or mutual funds and let them grow over time.

- Patience is key—compounding works only when you let time do its job.

3. Understand That More Money ≠ More Happiness

- The real value of money is the freedom to work less and spend time on what matters.

- Learn to differentiate between needs and wants—this will help you make better spending decisions.

4. Focus on Financial Independence, Not Just High Income

- A high salary doesn’t guarantee wealth—saving and investing wisely does.

- Even small, consistent investments can make you financially independent in the long run.

Who Should Read The Psychology of Money?

This book is highly recommended for:

✅ Investors & Stock Market Enthusiasts – Learn why behavior matters more than knowledge.

✅ Entrepreneurs & Business Owners – Understand risk, compounding, and wealth-building.

✅ Young Professionals & Beginners – Develop smart money habits from the start.

✅ Anyone Struggling with Money Management – Change your mindset about saving and investing.

If you want financial stability, investment confidence, and freedom from money-related stress, this book is a must-read.

Final Thoughts

The Psychology of Money is not just a finance book—it’s a guide to understanding human behavior, decision-making, and long-term financial success.

By adopting the right money mindset, making consistent investments, and avoiding emotional decision-making, anyone can build wealth and financial independence.

💡 Want more business & finance book summaries? Subscribe to our newsletter for regular insights! 🚀