In 2025, petrol prices in India continue to influence everything from household budgets to national economic policies. With rising fuel consumption, inflation concerns, and global oil market volatility, knowing the state-wise petrol price differences isn’t just relevant—it’s essential. But have you ever wondered why petrol costs less in one state and more in another?

Introduction: Why Petrol Prices in India Matter More Than Ever

In 2025, petrol prices in India continue to influence everything from household budgets to national economic policies. With rising fuel consumption, inflation concerns, and global oil market volatility, knowing the state-wise petrol price differences isn’t just relevant—it’s essential. But have you ever wondered why petrol costs less in one state and more in another?

This in-depth article breaks down current petrol prices in India, reveals the cheapest and most expensive states, and explains the real reasons behind these disparities.

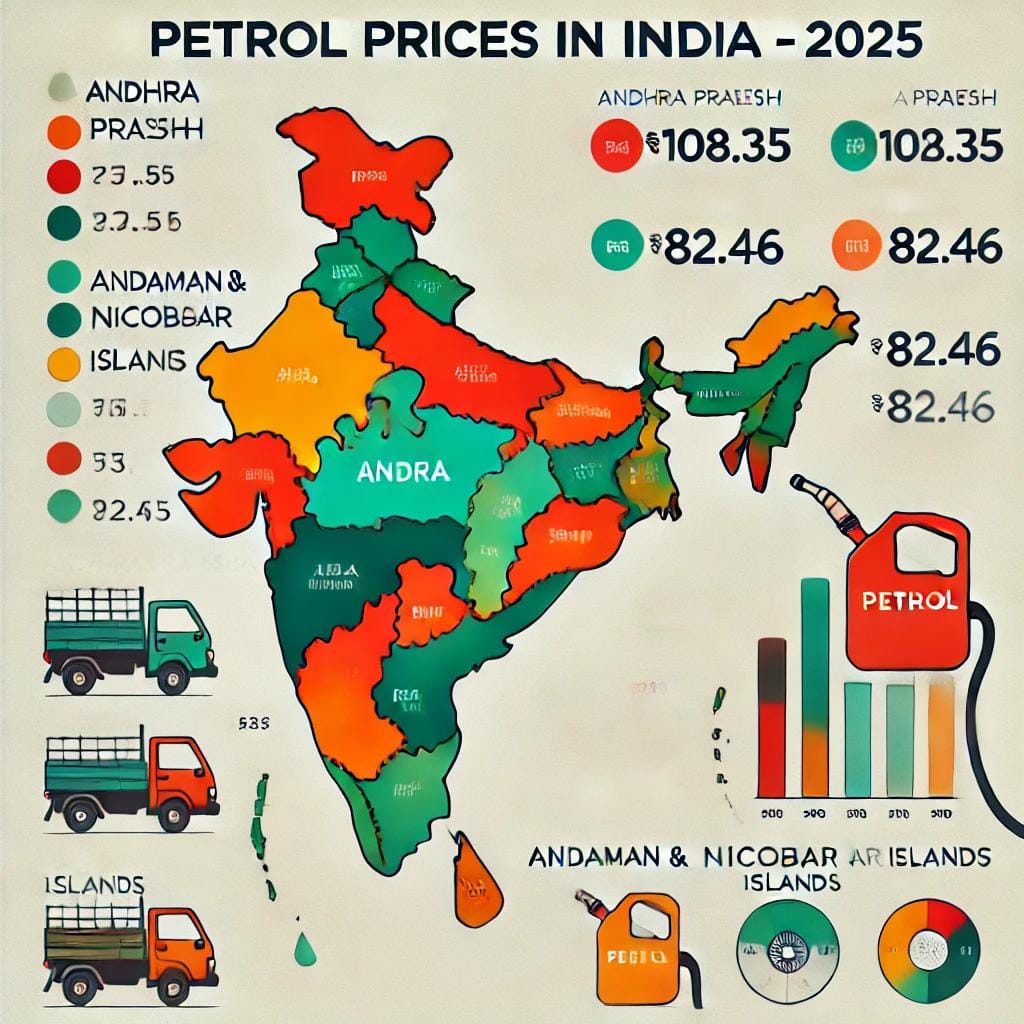

Latest Petrol Prices Across Indian States (As of March 21, 2025)

Here’s a quick overview of petrol prices from cheapest to costliest:

| State/UT | Petrol Price (₹/L) |

|---|---|

| Andaman and Nicobar Islands | ₹82.46 |

| Arunachal Pradesh | ₹90.67 |

| Chandigarh | ₹94.30 |

| Delhi | ₹94.77 |

| Gujarat | ₹94.80 |

| Tamil Nadu | ₹101.93 |

| Maharashtra | ₹103.50 |

| Rajasthan | ₹104.98 |

| Madhya Pradesh | ₹106.52 |

| Kerala | ₹107.48 |

| Andhra Pradesh (Highest) | ₹108.35 |

Source: Mint, Hindustan Times (March 2025)

Which State Has the Cheapest Petrol in India and Why?

Winner: Andaman and Nicobar Islands (₹82.46/L)

This Union Territory enjoys the lowest petrol price in the country. Here’s why:

- Reduced VAT & Excise: Central assistance ensures minimal taxation.

- Lower Dealer Margins: Due to public distribution control.

- Logistics Subsidy: Fuel is often transported via government-supported channels, reducing logistical costs.

Which State Has the Costliest Petrol in India and Why?

Top Spender: Andhra Pradesh (₹108.35/L)

Andhra Pradesh leads the chart for highest petrol prices. Key reasons include:

- High VAT: Among the highest state taxes in India.

- Local Levies: Additional surcharges by local bodies.

- Dealer Commission: Larger distribution network in semi-urban/rural areas increases commission rates.

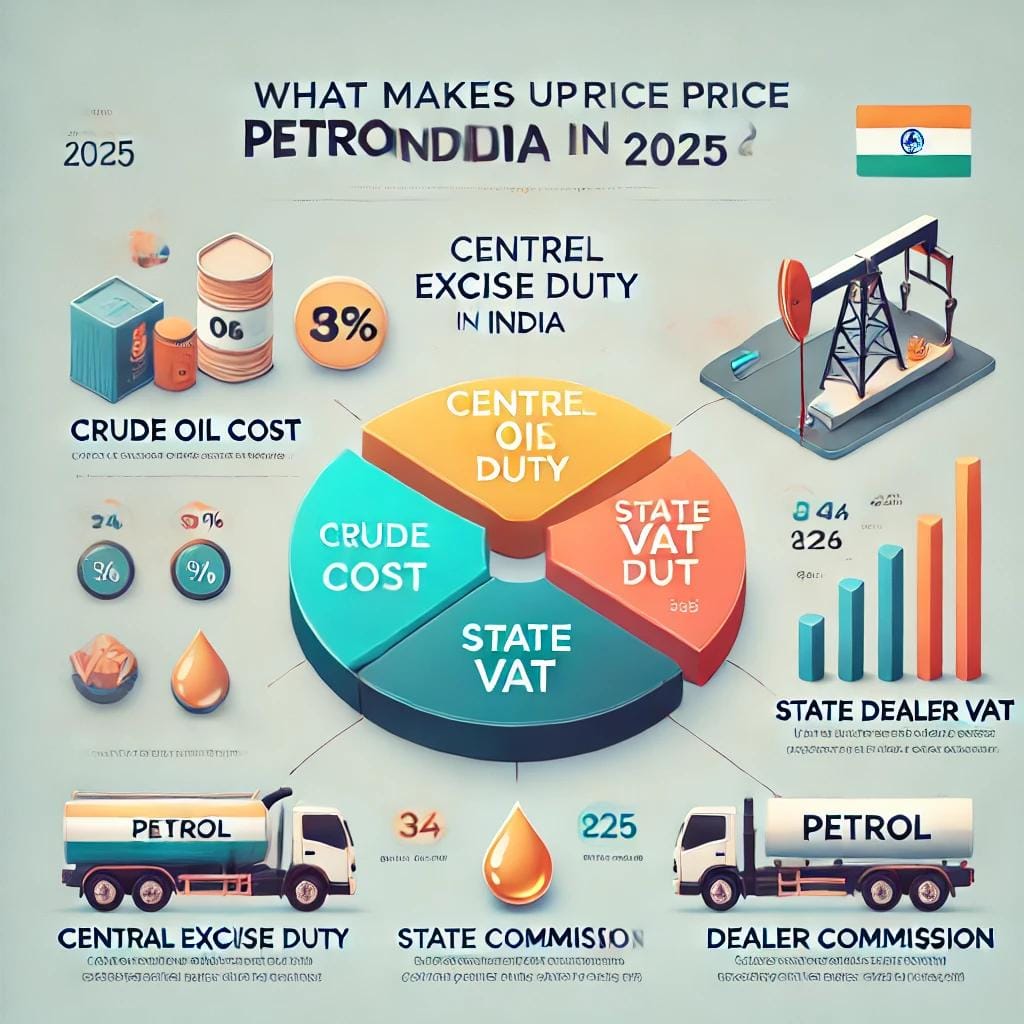

Factors That Influence Petrol Prices in India

Petrol prices in India are not uniform due to several critical components:

1. Crude Oil Prices (Global Influence)

India imports over 80% of its crude oil. Any international conflict or OPEC+ decision affects domestic prices almost instantly.

2. Currency Exchange Rate

The rupee-dollar exchange plays a vital role. A weaker rupee directly inflates petrol costs.

3. Central and State Taxes

Nearly 50% of petrol price comprises taxes. While central excise duty is fixed, VAT differs across states.

4. Transportation and Logistics

Fuel transported over long distances incurs higher freight costs. For example, hilly or remote states may pay more despite subsidies.

5. Dealer Commission

Commissions paid to petrol pump owners also vary by location and business model.

Interesting Facts About Petrol Pricing in India

- India is the 3rd largest oil consumer globally, after the US and China.

- Over ₹2 lakh crore in tax revenue is collected annually through fuel taxation.

- Despite falling crude prices in 2024, retail prices remained stable due to increased taxation.

- India is moving toward ethanol blending and EVs to reduce fuel import dependency.

What You Can Do: Tips for Saving on Petrol

- Fuel Smart: Use apps like Fuel@IOC or SmartDrive to find the lowest nearby prices.

- Drive Efficiently: Maintain correct tire pressure and avoid harsh braking.

- Plan Your Travel: Combine errands into one trip to reduce fuel consumption.

- Switch to EVs: Many cities now offer subsidies and free charging stations.

Final Thoughts: Understanding Fuel Economics is Financial Wisdom

Whether you’re a commuter, business owner, or policymaker, understanding petrol price dynamics helps make smarter financial and operational decisions. With fuel affecting everything from grocery bills to transportation costs, staying informed is your financial advantage.

As we move into a future focused on sustainability and efficiency, tracking and understanding fuel economics isn’t just smart—it’s necessary.

FAQs

Q1: Why doesn’t India have uniform petrol pricing? Taxes differ by state. Hence, each region sets its own retail rate based on tax structure and logistics.

Q2: Will petrol prices reduce in 2025? Unlikely unless crude oil prices drop or the government cuts taxes. Budget revisions and global factors will be key influencers.

Q3: Can state governments reduce prices? Yes. States can lower VAT or provide subsidies to ease consumer burden.

Do you know, now you can download any thumbnail of any youtuber for creating your own thumbnails. click to go there

External References: